Electricity Futures

Monthly Electricity Futures are exchange-traded, standardized, and cash-settled contracts that allow market participants to secure pricing for 28/30/31 days of round-the-clock (RTC) electricity delivery — equivalent to 24x7 hrs à well in advance (up to three months ahead).

Key characteristics of the product:

- No physical delivery is required; all contracts are financially settled.

- No transmission scheduling is needed since unconstrained market prices are used for settlement purposes.

- These contracts operate alongside the physical electricity market, providing a complementary financial instrument rather than being part of the physical trading or delivery process.

The product is designed to enable efficient hedging, and risk management, in electricity markets, helping participants manage exposure to price volatility.

- Article on "Electricity Derivatives: The Market India Needed, Finally Arrives"

- Volatility in Spot Electricity Market

- Brochure of Monthly Electricity Futures Contract

Physical Market Insights

Power Supply Position (MW)

Power Supply Position (MW)

Source wise generation (MU)

Source wise generation (MU)

Week Ahead All India demand forecast (MW)

Week Ahead All India demand forecast (MW)

Region wise transmission flow in real time

Region wise transmission flow in real time

Projected range of reserve requirements: TRAS-Up and TRAS-Down

Projected range of reserve requirements: TRAS-Up and TRAS-Down

Weather forecast: Rain, wind direction and temperature

Weather forecast: Rain, wind direction and temperature

Monthly Report on Short-term Transactions of Electricity in India

Monthly Report on Short-term Transactions of Electricity in India

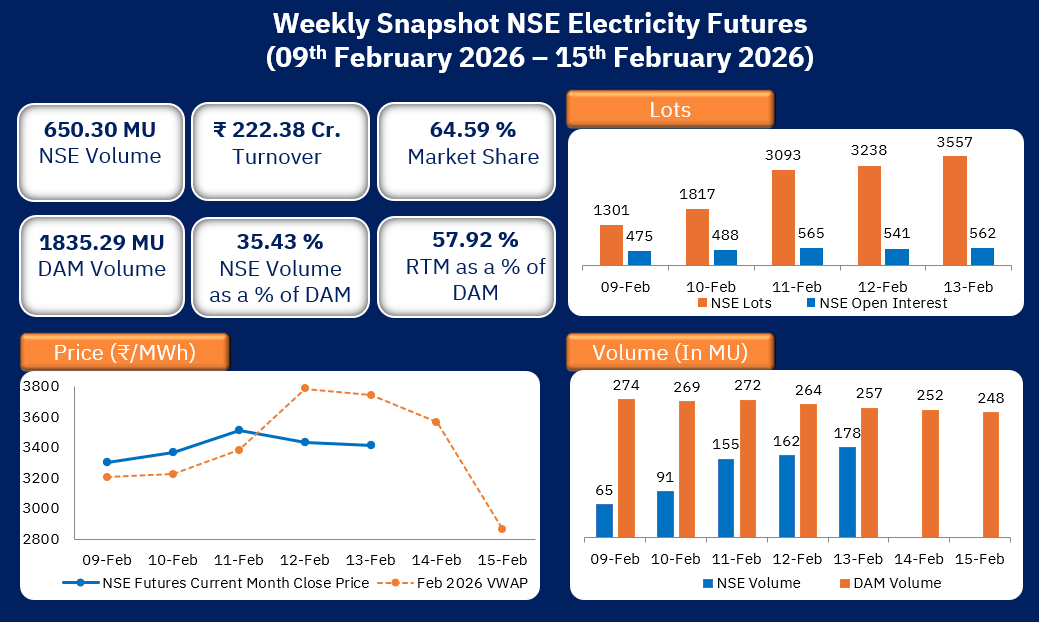

Historical Monthly DDR for Electricity Futures

Historical Monthly DDR for Electricity Futures

VWAP Calculator for Monthly Electricity Futures Contract

VWAP Calculator for Monthly Electricity Futures Contract

Relevant Circular Links

Participation of SEBI registered Foreign Portfolio Investors (FPIs) in Exchange Traded Commodity Derivatives in India

Introduction of Monthly Electricity Futures in Commodity Derivatives Segment

Clearing, Settlement and Risk management - Monthly Electricity Futures in Commodity Derivatives Segment

Volatility Category – Electricity Futures

Transaction charges for Monthly Electricity Futures Contract

Liquidity Enhancement Scheme - Electricity Futures

Liquidity Enhancement Scheme in Monthly Electricity Futures Contracts - Update on Effective Date

Introduction of Monthly Electricity Futures in Commodity Derivatives Segment w.e.f. 14th July 2025 - Update on Expiry Date for August 2025

Liquidity Enhancement Scheme – Monthly Electricity Futures

Next launch calendar of Monthly Electricity Futures in Commodity Derivatives Segments for November Month